Investing In Gold To

Avoid Catastrophic Events.

Accumulating or investing in gold has been seen as both a store of wealth and a safe haven against crisis throughout history.

Some Facts About Gold:

- Gold has risen every year over the past decade rising almost 30% in 2010 alone.

- In 2006 it was estimated all the gold ever mined totalled 165,000 tonnes.

- This amount would fit into a solid gold cube measuring just 66 x 66 x 66 feet (ref:Wikipedia).

- Gold has been used as money throughout history.

- The Gold Standard was used to back many European currencies from the late 1800's.

- President Nixon abolished the $U.S./Gold peg in 1971.

- The Swiss Franc was the last currency to ditch the gold peg in 2000.

- The World Gold Council estimates about 2,500 tonnes of gold is mined each year.

- Of this around 80% (or 2,000 tonnes) is used for jewellery, industrial and dental uses. The remaining

500 tonnes is available for investing in gold.

- Jewellery normally accounts for over 2/3rd's of annual gold demand.

- In 2009 gold's high price saw an extra 1,500 tonnes of "scrap" jewellery recycled as gold-buying-stands

sprang up everywhere.

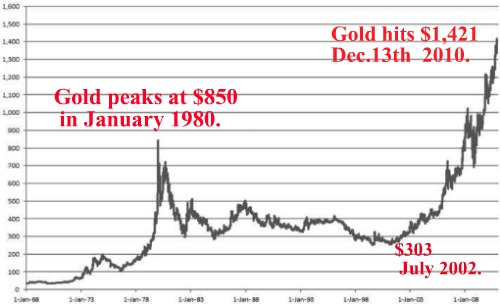

The Price of Gold.

Before investing in gold you need to understand that its price is volatile and can fluctuate wildly (although gold is not usually as volatile as silver... see investing in silver).

This volatility became more extreme after the $U.S./Gold peg was abolished.

"I do not under any circumstance favor raising the price of gold. It would perpetuate that "barbarous metal" in international monetary use. We have rightly broken the link between gold and our domestic money. We should also break the link between gold and international money. The supply of money... should not be dependent...on the... supply and demand in the marketplace for just one commodity".

GOLD CHART PAST 40 YEARS.

So before investing in gold you need to decide what percentage of your assets should you invest in gold?

One gold dealer thinks "a general rule of thumb is 10% to 30%...depending on how concerned you are about the current economic, financial and political situation".

But you'd expect a gold dealer to say that, wouldn't you?

More conservative financial advisors believe 2-5% would be more than enough as an asset-diversification play. They remind us of the following:

- Gold crashed from $850 in January 1980 to around $300 two years later... a loss of 65%!

- Gold bullion and coins earn no income stream,

- Investing in gold is pure speculation,

- Safe storage may mean storage fees, installing a safe, or securing a safety deposit box,

- Larger bullion bars and valuable gold coins are not as divisible or easy to tender as cash,

- Gold usually soars during periods of high Inflation (like from 1973 to 1982 where gold returned an average 17 percent

per year... twice as much as the Consumer Price Index). However, its performance during Deflation or Stagflation is less certain,

even though "gold bugs" are adamant the noble metal will retain value better than most asset classes,

- The gold price can be swept along by the massive buying power of Exchange Traded Funds and commodities speculators trading in Derivatives, CFDs, Futures, Options, Short Selling, etc.

How To Buy Gold.

- Allocated Bullion Bars (from 1/2 to 400 ounce) can be purchased from recognized banks and commercial custodians like

Australia's Perth Mint. Fakes (e.g. tungsten-filled bars) and scams abound... do your due diligence!

- Gold Coins...Bullion Coins or Numismatic... for more see how to invest in gold coins.

- Gold Mining Company Shares can be expected to rise with a rising gold price. They are, however, at the

mercy of bad management decisions, political turmoil, natural disasters, economic downturns, and the vagaries of the stock market.

- Exchange Traded Products (ETFs, CEFs and ETNs) are traded on major stock exchanges like shares. These "financial instruments" are an easy way to get

exposure (often leveraged) to gold. The first ETF was launched in 2003. Bundles of "paper assets" like unallocated certificates and "financial

instruments" aren't the same as owning the physical metal.

- Derivatives, CFDs, Futures, Short Selling, Spread Betting... are not for the novice investor. These are for experienced

speculators... 9 out of 10 investors in futures end up losing.

A 52 year old man was robbed of the bulk of his life savings in Chilliwack B.C. 100 km east of Vancouver. Two robbers, dressed as policeman, gained entry to his home and attacked him. They then forced him to open a 1mx1m safe containing the bullion and stole silver bars valued at $750,000.

The man had the silver stashed at home because his bank had refused to store it. It was uninsured because the cost would have been "astronomical".

The victim blamed "some friend..or friend of a family member" who "leaked it to the wrong people". Police warned that "people should think twice before storing valuables and cash at home".

Security is absolutely vital if storing valuable bullion bars or coin collections at home.

When investing in gold bullion or coins a bank safety deposit box may be a wise consideration. If you do decide to install a discrete, secure safe in your home, total discretion must be maintained with friends, family and acquaintances to minimize the risk of burglary or robbery.

Who Ate My Lunch?

by Eugene Roberts

The Internet Revolution, Globalization, and the Global Financial Crisis created the perfect storm... Old Business models are being destroyed and jobs are disappearing offshore at an astonishing rate. Analysts warn that "China and India are poised to out-think us and out-compete us by their sheer numbers" and that "there is no job security now".

Read more of

Who Ate My Lunch?

for free.